Mastering FX Trend Detection

AIによる英訳ですThis has been translated into English by AI.

Mastering FX Trend Detection: Change Your Future with Simple Tips!

In FX trading, mastering FX trend detection is crucial. Understanding market trends makes it easier to identify entry and exit points. Here, we’ll explain how even beginners can detect trends in a simple, easy-to-understand way.

✅ What is a Trend?

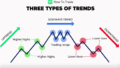

A trend refers to the general direction in which the market price moves. There are three main types: uptrend (prices rising), downtrend (prices falling), and range (sideways movement).

📈 3 Simple Ways to Detect Trends

Here are three simple methods for beginners to identify trends:

🌟 1. Use Moving Averages

Moving averages are a great tool for spotting trend directions. The relationship between short-term and long-term lines helps determine whether it’s an uptrend or downtrend.

🔍 2. Observe Highs and Lows

Check if prices are making higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

📊 3. Draw Trendlines

Drawing trendlines on a chart can give you a visual idea of market direction. If the price respects these lines, it indicates a strong trend.

💡 Make Trends Your Ally!

By mastering FX trend detection, you can avoid unnecessary trades and aim for bigger profits. Practice little by little and make trends your ally!

Even beginners can master FX trend detection with the right tips. Give it a try!

コメント