FX Trend and Range

AIによる英訳ですThis has been translated into English by AI.

FX Trend and Range: Essential Strategies for Winning Trades

Thank you so much for reading! This guide is designed to help both beginners and experienced traders better understand FX trend and range to level up your trading game.

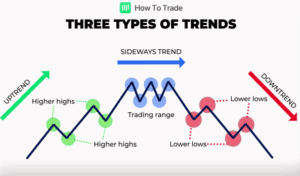

1. What Is a Trend Market?

A trend market shows clear upward or downward movement. In an uptrend, lows rise; in a downtrend, highs fall. The key highlight? Riding the trend creates consistent profit opportunities.

2. What Is a Range Market?

A range market moves sideways between support and resistance. Effective strategies include entering at range boundaries or preparing for a breakout once the price exits the range.

3. Trend vs. Range: How to Tell the Difference

- ADX Indicator: Below 25 indicates a range, above 25 signals a trend.

- Price Patterns: Three consecutive rising lows or falling highs confirm a trend.

- Volume: Typically increases when a trend starts.

4. Effective Trading Strategies

– Trend Following

Buy on pullbacks or sell on retracements using trend lines or moving averages. Following the flow yields higher probability trades.

– Range Trading

Buy at support, sell at resistance, clarify targets within the range, and cut losses on breakout reversals.

– Range Breakout

Enter on a breakout above or below the range, ideally supported by volume. The potential payoff is often substantial.

5. Key to Success: Correct Analysis + Strategy Matching

By accurately identifying the market structure and matching it with the right strategy, you can manage risk while maximizing returns.

I hope this article brings value to you and your trading. Thank you again for reading!

コメント